Speculative dynamics of prices and volume

Anthony A. DeFusco, Charles G. Nathanson, and Eric Zwick

Journal of Financial Economics 146(1) (2022): 205-229.

Volume cycles in bubbles due to the entry and exit of short-term investors, who sell frequently.

Additional links: free version, supplementary materials

Housing supply and affordability: Evidence from Rents, Housing Consumption and Household Location

Raven Molloy, Charles G. Nathanson, and Andrew Paciorek

Journal of Urban Economics 129 (2022)

Although regulatory restrictions on new construction raise house prices, they have much smaller effects on rents and the size of new homes.

Additional links: free version, supplementary materials

On the effects of restricting short-term investment

Nicolas Crouzet, Ian Dew-Becker, and Charles G. Nathanson

Review of Financial Studies 33(1) (2020): 1-43

[Lead article and editor’s choice]

Restricting short-term trading hurts short- and long-term professional investors but may help less sophisticated investors.

Additional links: free version

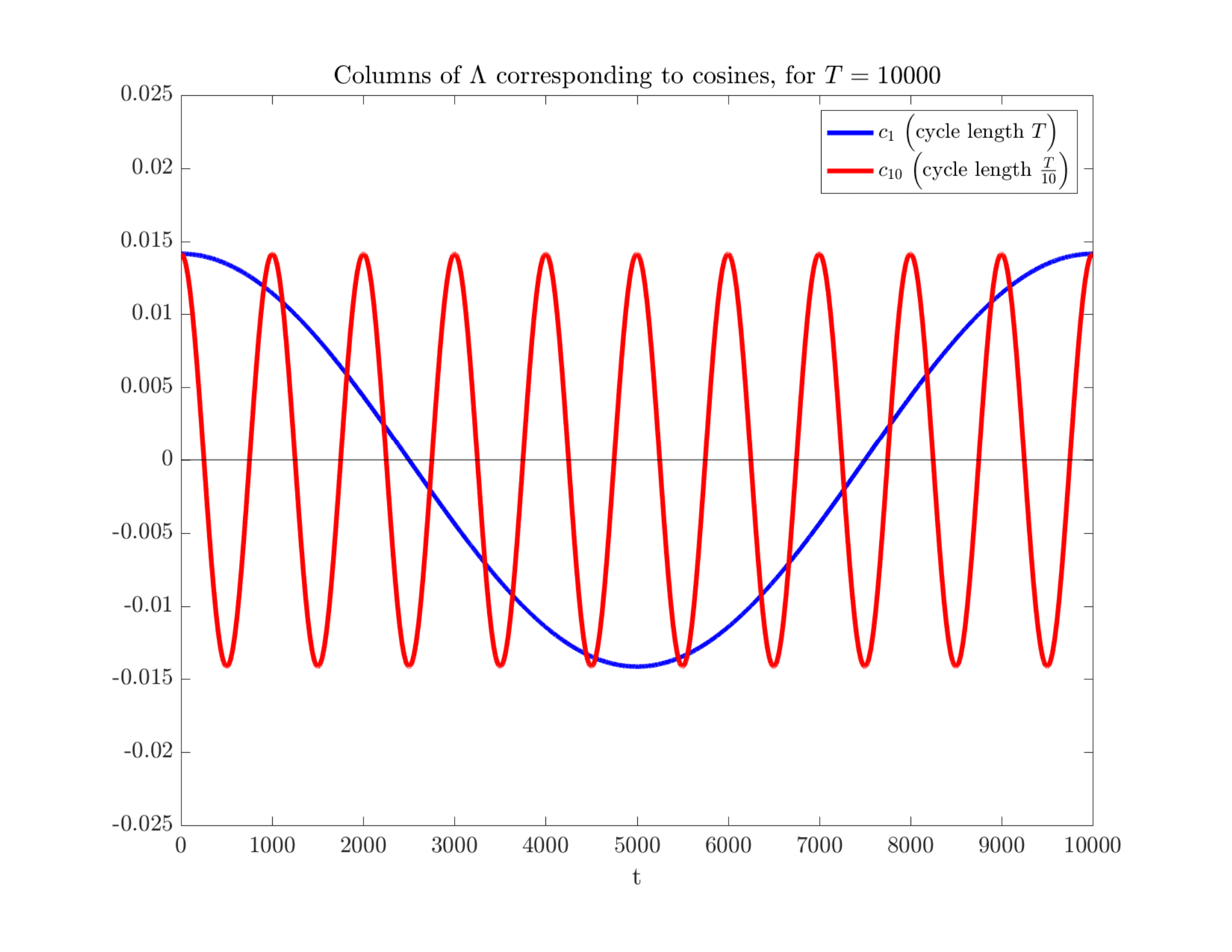

Directed Attention And Non-parametric learning

Ian Dew-Becker and Charles G. Nathanson

Journal of Economic Theory 181 (2019): 461-496

An optimal boundedly rational model captures low-frequency but not high-frequency dynamics of income.

Additional links: free version

ARRESTED DEVELOPMENT: THEORY AND EVIDENCE OF SUPPLY-SIDE SPECULATION IN THE HOUSING MARKET

Charles G. Nathanson and Eric Zwick

Journal of Finance 73(6) (2018): 2587-2633

Speculation reverses the common intuition that elastic housing supply attenuates house price booms.

Additional links: free version, replication files (15.9 MB)

An extrapolative model of house price dynamics

Edward L. Glaeser and Charles G. Nathanson

Journal of Financial Economics 126(1) (2017): 147-170

A modest approximation to rationality leads house prices to display momentum, mean reversion, and excess volatility.

Additional links: working paper, simulation replication files

Taxation and the allocation of talent

Benjamin B. Lockwood, Charles G. Nathanson, and E. Glen Weyl

Journal of Political Economy 125(5) (2017): 1635-1682

When different occupations have different spillover benefits (or costs) to society, the income tax can increase efficiency by incentivizing workers to choose more productive jobs.

Additional links: supplemental appendix, replication files (23 MB)

housing bubbles

Edward L. Glaeser and Charles G. Nathanson

Handbook of Regional & Urban Economics, Vol. 5 (2015)

The most promising explanations of real estate bubbles emphasize

some form of trend-chasing, which in turn reflects boundedly rational learning.

Additional links: NBER working paper

Housing dynamics: an urban approach

Edward L. Glaeser, Joseph Gyourko, Eduardo Morales, and Charles G. Nathanson

Journal of Urban Economics 81 (2014): 45-56

A rational, spatial-equilibrium model estimated with city-level income data captures some of the mean reversion and volatility in house prices, but none of the short-run persistence.

Additional links: free version, supplemental appendix

calculating evolutionary dynamics in structured populations

Charles G. Nathanson, Corina E. Tarnita, and Martin A. Nowak

PLoS Computational Biology 5(12): 45-56 (2009)

An easily computable statistic determines which strategy in a 2-by-2 game is evolutionarily stable when that game is played on a given graph.